Mastering Debt Management: Essential Strategies for Small Business Success

One of the most significant challenges many small business owners face is managing debt. While debt can be a useful tool for growth and expansion, it can also become a burden if not managed properly.

Navigating Financial Audits: Essential Preparation Tips for Small Business Owners

An audit provides an opportunity to ensure your financial records are accurate, identify areas for improvement, and demonstrate your business's financial integrity to stakeholders.

Unlocking Success: The Top Benefits of Hiring a Bookkeeper for Your Small Business

While some business owners attempt to handle their bookkeeping themselves, hiring a professional bookkeeper can offer numerous advantages that can significantly impact your business's success.

Unlocking Financial Clarity: A Guide to Mastering Financial Statements

Financial statements provide a snapshot of your business's financial performance and position, helping you to track progress, identify trends, and plan for the future. In this guide, we'll break down the three primary financial statements: the balance sheet, income statement, and cash flow statement.

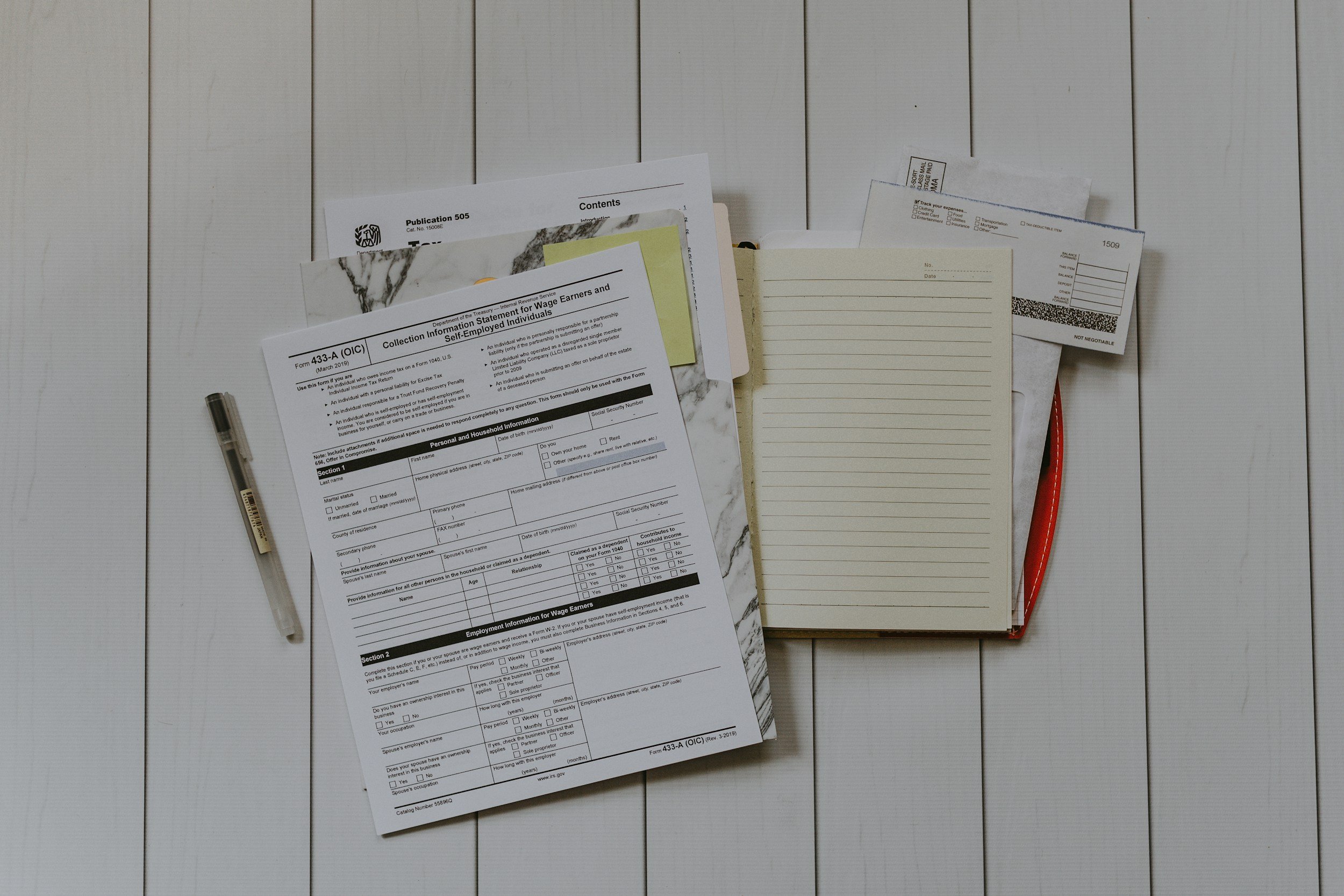

Home Sweet Tax Deduction: Unleash the Power of Your Home Office

The home office deduction is a valuable tax benefit for small business owners and self-employed individuals who use a portion of their home for business purposes.

The QBI Deduction: Your Secret Weapon for Slashing Business Taxes

The Qualified Business Income (QBI) deduction, introduced by the Tax Cuts and Jobs Act of 2017, offers a valuable tax break for owners of pass-through businesses.

Employee vs. Contractor: Key Differences and Legal Implications

When it comes to hiring workers, businesses have two main options: employees or contractors.

Mastering Church Bookkeeping: Ensuring Financial Integrity and Compliance

For churches and religious organizations, maintaining accurate financial records is not just a legal obligation but a sacred responsibility. Proper bookkeeping ensures transparency, accountability, and the responsible stewardship of the resources entrusted to you by your congregation and community.

The New Entrepreneur's Guide: 10 Tax Tips to Kickstart Your Business on Solid Financial Footing

Among the many considerations entrepreneurs must grapple with, understanding and fulfilling tax obligations is crucial to ensuring compliance and maximizing profitability.

Mastering the Books: Bookkeeping Essentials for Property Managers

Proper bookkeeping not only helps you stay compliant with tax regulations but also provides valuable insights into your company's financial health.

Adapting to Evolving Bookkeeping Industry

The bookkeeping industry is undergoing a transformation driven by technological advancements and changing business dynamics.

Honoring Those Who Paid the Ultimate Price

Memorial Day is a solemn occasion to reflect on the tremendous cost of protecting our nation's freedoms.

Understanding Financial Statements: Essential Guide for Non-Accountants

Having a basic understanding of financial statements is crucial for anyone involved in business, investing, or managing their personal finances.